Now Online NTN Inquiry & verification is possible due to the online FBR all-in-one portal. Both NTN & STRN details can be found via CNIC and Passport numbers.

In 2024, we have updated this article so that you can easily get help from our article and collect information about your tax-paid history. This option also gives you a possible way to download your details from the NTN/STRN page.

Checking the NTN/STRN is possible via NTN, CNIC, Passport Number, and Registration Number. Hence, provide your one number from these possible options and follow these steps to get your FBR NTN / STRN verification.

Online NTN Inquiry & Verification

Not only NTN but it also provides you full details about the STRN account. Inquiry of both types of numbers is the same, except a few steps. We have described each step with an image guide here on this page.

Remember that the user must have an internet connection to inquire the following details. You have to follow these steps according to the images guide given below and check your FBR NTN / STRN details today for free.

1st Step:

Please click here the Official FBR Website and open the verification website.

2nd Step:

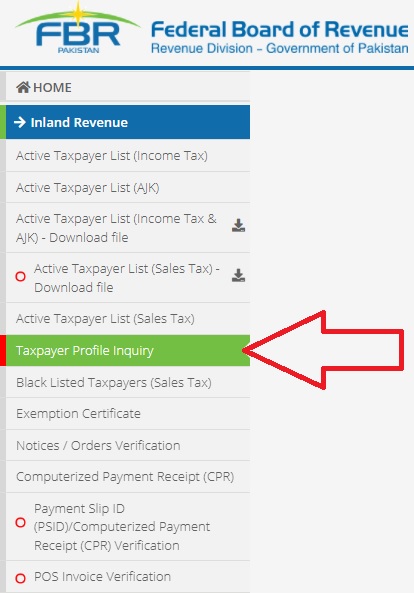

Now click on “Taxpayer Profile Inquiry” present on the left side middle of the menu.

3rd Step:

Select your parameter type among NTN, CNIC, Passport No, and Reg/Inc No.

4th Step:

It’s time to provide your registration number in the basic inquiry next field.

5th Step:

Resolve the Captcha, and click on the verify button to check through the FBR database.

6th Step:

On the next page, you will get your “Online FBR NTN / STRN Inquiry” on an all-in-one description page. This inquiry example is given below:

What Type of Info Do We Get?

According to the above example, we will be able to get basic info about (NTN) National Tax Number or (STRN) Sales Tax Registration Number that will surely contain:

- Name

- Category

- NTN or STRN

- Email Address

- PP/REG/INC No

- Official Address

- Reference Number

- Tax Office Location

- Cell Phone Number

- Registered Number

- Registration Number

- Current Registration Status

Additional Check Options

In the older version, the user can only use a CNIC card to inquire about FBR NTN / STRN. But due to over-requests of Pakistani citizens, the Government of Pakistan has updated its old database and now the user has the following 4 options to check their STRN:

- NTN

- CNIC

- Passport Number

- Reg/Inc. Number

Click here and get info about step by step method to get register your cell phone in the PTA Mobile Registration database for free from the official guide article of Apna4G.

Why We Need NTN & STRN?

Basically, NTN stands for “National Tax Number” and it is a key point that government provides to those people who have paid taxes. Hence, we can say that Pakistani taxpayer personalities have their proof of recently paid taxes through NTN. That’s why every Pakistani special (VIP + Business tycoons) who paid their taxes regularly must have their NTN for having FBR support.