The government of Pakistan is giving away loans with zero interest in Kamyab Jawan Program. Hence start your own business with new potential without any tension of monthly or yearly interest.

With the arrival of Imran Khan, he launched many schemes and programs. These schemes proved very helpful to make many people’s lifestyles easy. Hence, we have discussed that early program that was closed after few months after its launching.

Now the good news is that the government of Pakistan has reopened Kamyab Jawan Program or also known as Nojwan Rozgar Scheme. This scheme will provide loans to the youth of the country to start their own desired business. Hence, it may prove as a golden chance to improve the condition of the country.

Kamyab Jawan Program 2024

According to Kamyab Jawan Program the Government of Pakistan will provide different loans according to the requirements of the applicant. The best part of this loan is its low-interest rate which is nearly equal to nothing. Hence, don’t miss this golden chance to get your business loan today.

According to many experts, the financial condition of Pakistan will automatically get better after unemployment gets vanishes. To make the financial condition of Pakistan stronger than in previous governments, the PM has to start this program for all Pakistani regions.

Jawan Program Features

Here we have described the basic features Kamyab Jawan Program or Nojwan Rozgar Scheme in detail. Please note that you can only eligible to apply for this loan if you complete specific requirements:

| Applicant | Scheme |

| Age | 21 to 45 |

| Gender | Male/Female/TG |

| Loan Type | Long + Short Term |

| Loan Tenor | 8 Year |

| Grace Period | 1 Year |

| Loan Repayment | Monthly |

| Charges | PKR 100 |

Loan Amount

There are three basic types of loan categories to which you can apply. If you have all those features that are given above, then you are eligible for the loan.

| Govt. Loan | Pricing |

| PKR 0.1 M to PKR 1 M | 3% per annum |

| PKR 1 M to PKR 10 M | 4% per annum |

| PKR 10 M to PKR 25 M | 5% per annum |

How To Apply For Loan?

All leading banks of Pakistan are associated with the government of Pakistan. Hence, this collaboration is giving away loans to Pakistani youth. Start a new business or increase your business with a loan. Here is the list of required documents to apply for the Kamyab Jawan Program loan.

- NTN Copy

- CNIC Copy

- Degree Copies

- Applicant image

- E. Bill Consumer No

- Two Reference ID Card

See: Ehsaas Program

Just collect these documents and apply online for the Kamyab Jawan Program loan and start your new business your potentially increase your current one.

9 Steps To Apply

There are official 9 steps that you have to complete one by one to apply for a loan. We have described each step with complete details and image representation:

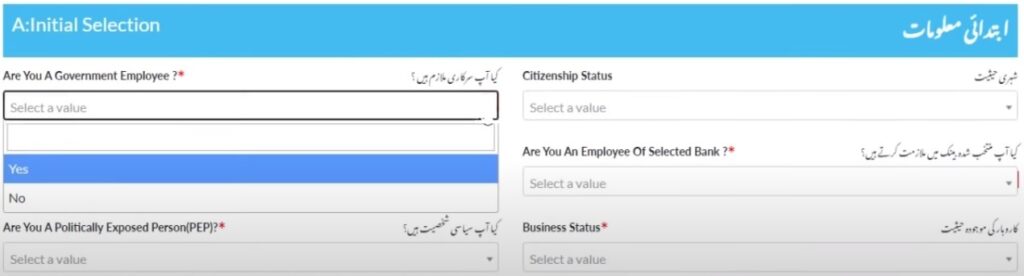

1st Step (Initial Selection)

In the first step, you have to provide your basic details and info. This step is known as the basic part of your loan-based information.

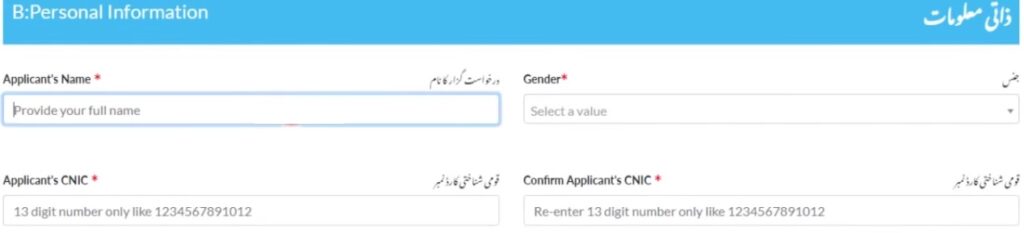

2nd Step (Personal Information)

The applicant’s name, and parent’s details with their personal description will be present in this section.

3rd Step (Qualification Details)

The third step contains the whole qualification details of the applicant. Here your skills and education will be mentioned.

4th Step (Contact Details)

Provide your address, phone number, or other sources of contact that will prove helpful to reach you in seconds. Hence, contact section is the fourth step.

5th Step (Business Info)

This step has been given to those applicants who want to increase their business and have their own small or previous business. In this section, they have to provide their current business details.

6th Step (Financing Details)

This is the detailed section of that loan you are going to take from this service. Hence, section six will provide financing details in a tab.

7th Step (Business Plan)

What are your monthly expenses and where this loan is going to use? All details will present here, and you have to follow each section according to your condition.

8th Step (Financing History)

Your current and whole financing history will be mentioned in this tab. Hence, the bank will be aware of your current financing conditions and your previous financing history.

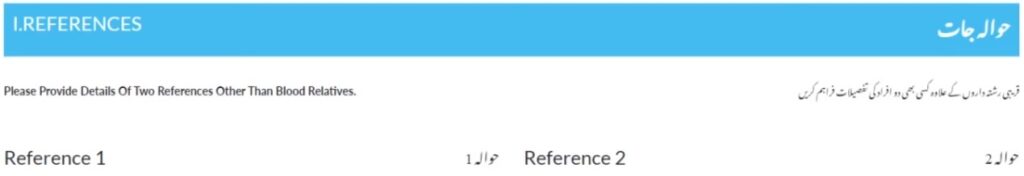

9th Step (References)

You have to provide references of two people who must be your blood relative. This reference will be use for security purposes.

Declaration (Last Step)

In the end, you have to confirm the declaration that applicant s/o applicant will remain bound to terms and conditions and repay the loan in time.

Declaration (Halaf Nama) is the security sign page on which you allow the authorities to perform court and law actions in case of delay or any other condition while repayment of the loan. Click here for an official website visit and to apply on that page.

1 thought on “Kamyab Jawan Program Online Registration & Application Status”

Comments are closed.